Tastyworks Futures Margin Requirements

Futures trading opens up many opportunities but it’s important to fully understand Tastyworks futures margin requirements before getting started. Tastyworks margin requirements determine how much buying power you have available for opening and maintaining futures positions. By learning the key aspects of Tastyworks futures margin requirements, you’ll be able to trade futures strategically while protecting your capital.

What is Margin?

When trading futures, you’re not actually buying or selling the underlying asset. Instead, you’re entering into a contract to buy or sell the asset at a future date. Margin acts as a good faith deposit that protects both you and the exchange from losses if the market moves against your position.

Tastyworks futures margin requirements refer to the minimum amount of money you need to have in your account to enter and maintain a position. The exchange sets these requirements, and Tastyworks enforces them on behalf of the exchange. Margin protects both sides of the trade by ensuring there is enough money in the account to handle potential losses.

Initial And Maintenance Margin

There are two types of margin to be aware of with Tastyworks futures trading: initial margin and maintenance margin. Initial margin is the amount you need to put down to open a position. Maintenance margin is the minimum amount you need to keep in your account to hold an open position.

If your account equity drops below the maintenance margin level, Tastyworks will issue a margin call requiring a deposit to bring your account back up to the initial margin. This protects the exchange in case the market moves further against your position.

How Are Margins Calculated?

The margin requirements differ based on the type of futures contract. Typically contracts, with volatility such as cryptocurrency futures have margin requirements compared to contracts with lower volatility like treasury futures.

Tastyworks determines margins using a Risk Based Margin (RBM) approach, which establishes requirements according to the price volatility of each product, over a specified period. This implies that margins can change as market conditions evolve over time.

Margin Rates For Popular Futures

To give you a sense of typical Tastyworks futures margin requirements, here are the initial and maintenance margin rates for some commonly traded:

Bitcoin futures typically require a margin of 20-30% of the contract value with a maintenance margin of about 15-25%. Ether futures follow a pattern, with margins around 20-30% and maintenance margins ranging from 15-25%.

When it comes to S&P 500 futures the initial margin is usually in the range of 5-10% with a maintenance margin of around 3 5%. Nasdaq 100 futures operate on a scale with margins typically at 5-10% and maintenance margins around 3-5%. For those trading in 10 year Treasury note futures expect initial margins to be between 1 3% and maintenance margins falling within the range of 0.5-1%.

It’s worth noting that the margin requirements vary based on the volatility levels being lowest for indexes like S&P500 and Nasdaq100 and highest for more volatile cryptocurrencies such, as Bitcoin and Ether. Additionally it’s important to keep in mind that Tastyworks utilizes its Risk Based Margin system for all calculations.

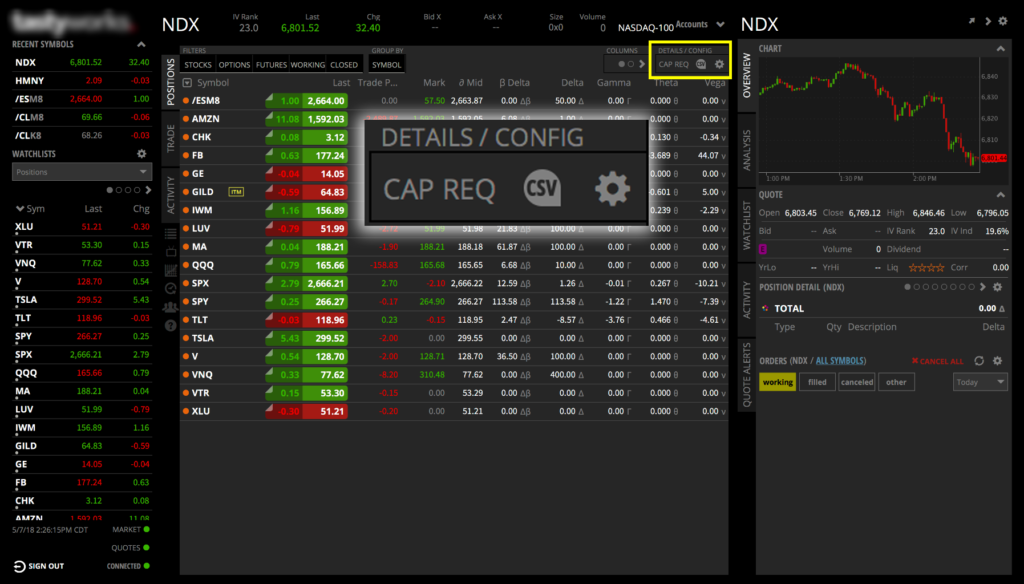

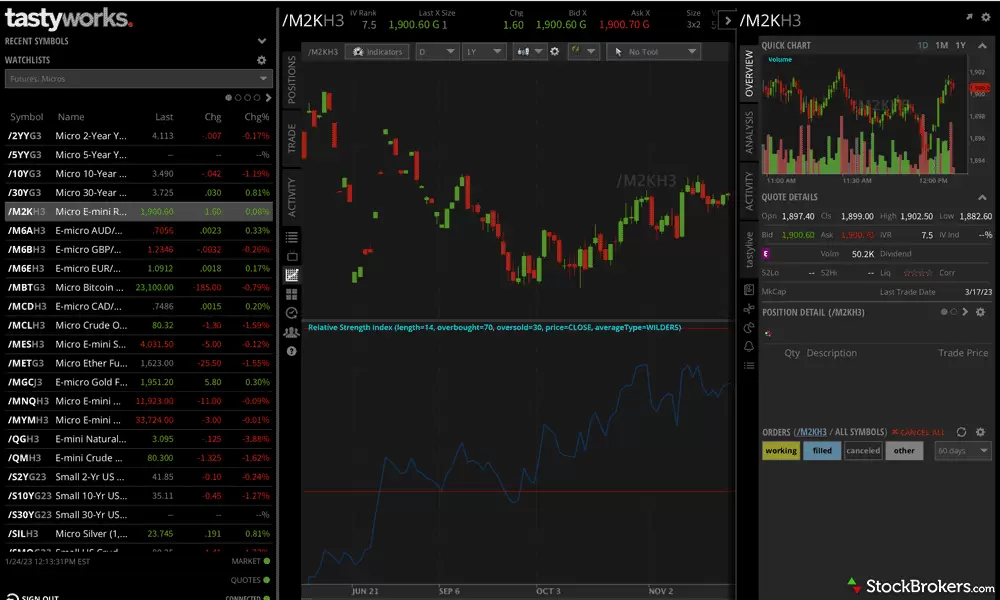

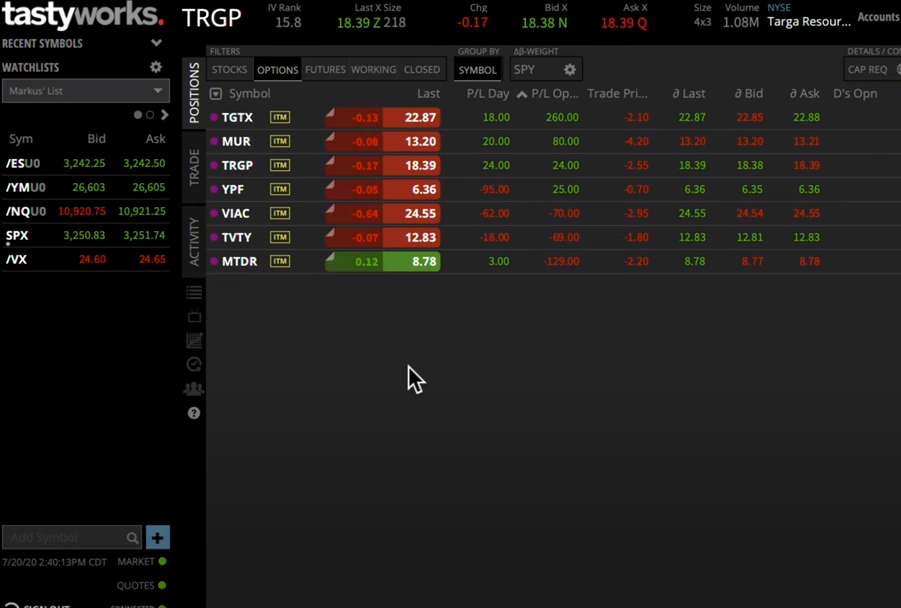

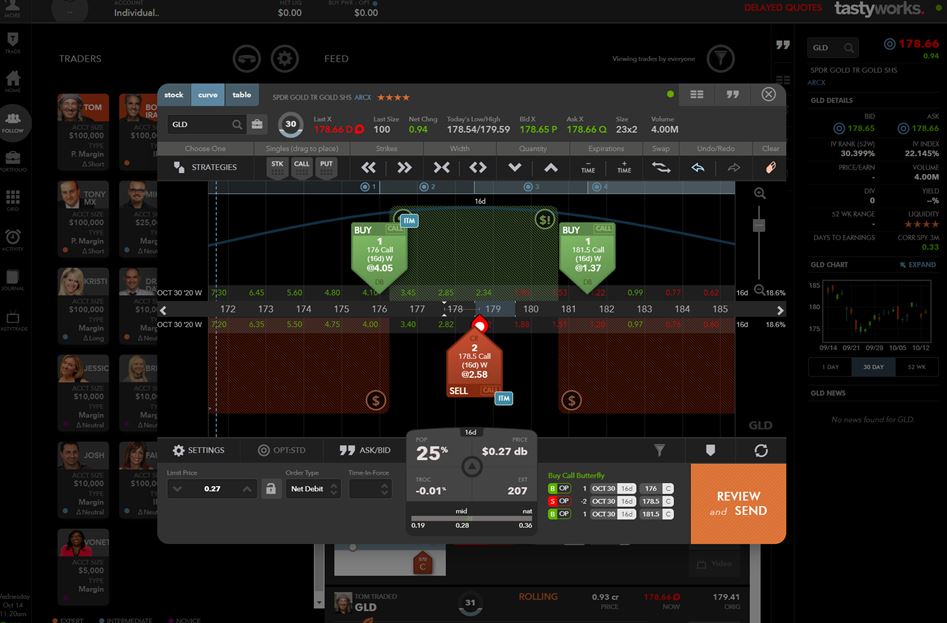

How To Check Your Margin Requirements

Checking your specific Tastyworks futures margin requirements is easy. Just log in to your account and go to the “Positions” screen. Here you’ll see your current initial and maintenance margin levels for each open futures contract.

You can also check the “Markets” screen to view the base rates before entering a new position. Tastyworks clearly displays the initial and maintenance margins upfront so you always know how much buying power you need.

Why Do Tastyworks Requirements Matter?

Understanding Tastyworks futures margin requirements is important because margins determine how much buying power you have available. Tastyworks enforces the margin levels set by the exchange to protect all parties in the trade. If you don’t maintain enough equity in your account to meet the Tastyworks futures margin requirements, your positions are at risk of being liquidated.

How Can You Reduce Your Tastyworks Margin Requirements?

While Tastyworks calculates margins based on volatility, there are a few things you can do to potentially lower your Tastyworks futures margin requirements. Trading smaller contract sizes means you only need margin for a portion of each contract’s full value.

You can also improve your trader level at Tastyworks over time by gaining more experience, which may qualify you for reduced margins. Maintaining a diversified portfolio instead of concentrating all positions in one or two highly volatile products can also work to lower your overall margin needs.

What Happens If You Can’t Meet The Tastyworks Futures Margin Requirements?

It’s critical that you always maintain enough equity in your account to meet the Tastyworks futures margin requirements. If the market moves against your positions and your account equity falls below the maintenance margin level, Tastyworks will issue a margin call requesting additional funds be deposited.

If you can’t meet this margin call, Tastyworks reserves the right to start liquidating positions to bring your account back up to the initial margin. Closed positions due to liquidation could result in losses. To avoid this, be sure to closely monitor your account and always understand the Tastyworks futures margin requirements for your open positions.

Final Thought

Tastyworks futures margin requirements aim to protect all parties in the trade while still keeping futures accessible. Their Risk Based Margin system sets dynamic levels tailored to each product’s volatility. With Tastyworks clearly showing margins upfront, you’ll always know exactly how much buying power is required. Futures trading doesn’t need to be intimidating when you understand the basics of margins.